2026 Strategic Property Outlook: Why Tengah and Bayshore are the New Pillars of Singapore Real Estate

As we cross into 2026, the Singapore residential market has entered a phase of “Sustainable Growth.” With private property price increases moderating to a healthy $3\%$ to $4\%$ and the market successfully absorbing previous cooling measures, the focus for savvy investors has shifted toward value extraction from major infrastructure completions. The two most significant stories of this year are the full operationalization of the Jurong Region Line (JRL) in the West and the completion of the Thomson-East Coast Line (TEL) Stage 5 in the East. These transit milestones have turned the “future potential” of Tengah and Bayshore into immediate, high-yield realities.

The West: Mastering the Art of Forest Living

Tengah is no longer a town of the future; it is the town of today. With the 20th edition of the Emerging Trends in Real Estate report ranking Singapore as a top destination for income stability, Tengah represents the perfect intersection of government-backed urban planning and resilient residential demand. The district’s “car-lite” philosophy has become its strongest selling point, attracting a new generation of homeowners who prioritize environmental sustainability alongside professional connectivity.

Central to this transformation is the first-mover advantage offered by Tengah Garden Residences. As the first major private residential plot in the area to feature a significant commercial component, it serves as the lifestyle anchor for the precinct. Investors are particularly focused on the Tengah Garden Residences facilities, which go far beyond standard gym-and-pool offerings. The development features smart-energy management systems, automated waste collection, and biophilic social spaces that integrate directly with the town’s 5-kilometer forest corridor. For the 2026 buyer, these features aren’t just luxuries—they are essential components of a modern, low-carbon lifestyle that drives long-term asset value.

Furthermore, the surge in demand for family living in Tengah has been bolstered by the “ACS effect” and the maturity of local amenities like the Plantation Plaza Neighborhood Centre. The safe, pedestrian-centric design of the town means children can commute to schools and parks without crossing a single major road at grade. This unique safety profile is creating a “sticky” tenant base of young families, ensuring that vacancy rates in Tengah remain among the lowest in the Outside Central Region (OCR).

The East: The Bayshore Waterfront Revolution

While the West is defined by its forests, the East is being redefined by its coastline. The 2026 completion of the Bedok South and Sungei Bedok MRT stations has fundamentally changed the calculus for East Coast living. Bayshore is now a mere 20-minute direct commute to the Marina Bay Financial Centre, making it the premier choice for high-income professionals who refuse to choose between work and wellness.

In this competitive landscape, Vela Bay has emerged as the definitive luxury benchmark. Standing at the doorstep of the new transit nodes, the development captures the essence of a modern urban lifestyle Vela Bay represents—one where the tranquility of the sea meets the efficiency of a global hub. The project’s architecture, characterized by expansive glass facades and nautical motifs, maximizes the unblocked views of the Singapore Strait, a rarity in a land-scarce city.

The investment thesis for the East Coast in 2026 is driven heavily by the Vela Bay condo features. Developers have responded to the “work-from-anywhere” trend by incorporating high-tech co-working pavilions, private meeting suites, and ultra-high-speed digital infrastructure into the common areas. These lifestyle-centric features, combined with the scarcity of new waterfront land, have allowed property values in the Bayshore corridor to outperform the broader market, setting new benchmarks for the Rest of Central Region (RCR).

Investment Analysis: Comparing the 2026 Frontrunners

For investors deciding where to deploy capital in the second half of the decade, the choice comes down to the nature of the growth they seek.

| Investment Metric | Tengah Precinct | Bayshore Precinct |

| Growth Driver | Infrastructure Inception (JRL) | Connectivity Completion (TEL) |

| Primary Demographic | Young Families & Tech Professionals | Expatriates & Wealth Managers |

| Sustainable Edge | Car-lite/Eco-innovation | Coastal Preservation/Smart Luxury |

| Projected Yield | $3.7\% – 4.3\%$ | $3.3\% – 3.9\%$ |

The “Western Gateway” (Tengah) offers a higher potential for capital appreciation as the Jurong Lake District matures into Singapore’s second CBD. Conversely, the “Eastern Gateway” (Bayshore) offers higher rental stability and prestige, catering to an audience that values the heritage and lifestyle of the East Coast.

Conclusion: A Tale of Two Gateways

The real estate narrative of 2026 is one of balance. Whether it is the community-centric family living in Tengah or the high-octane urban lifestyle Vela Bay provides, the market is rewarding developments that offer a clear, integrated purpose. The days of speculative buying based on generic location are gone; today’s winners are those who align their portfolios with the specific lifestyle shifts of the post-2025 economy.

As supply in the suburban market begins to thin toward the end of the year, the opportunity to enter these growth corridors at current valuations is closing. Both the West and the East offer compelling reasons for entry, but for those seeking a blend of nature, technology, and transport, the current window in Tengah and Bayshore is arguably the most strategic entry point in the last decade.

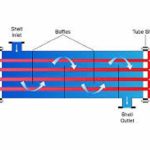

- What are the Advantages of Plate Heat Exchangers in Modern Industries?

In today’s fast-evolving industrial landscape, efficiency, sustainability, and cost control are more important than ever.… Read more: What are the Advantages of Plate Heat Exchangers in Modern Industries?

In today’s fast-evolving industrial landscape, efficiency, sustainability, and cost control are more important than ever.… Read more: What are the Advantages of Plate Heat Exchangers in Modern Industries? - Resin Bonded Surfaces: Best Uses and Advantages for Residential Driveways and Gravel Surfacing

Choosing the right surface for a residential outdoor space is about more than just looks… Read more: Resin Bonded Surfaces: Best Uses and Advantages for Residential Driveways and Gravel Surfacing

Choosing the right surface for a residential outdoor space is about more than just looks… Read more: Resin Bonded Surfaces: Best Uses and Advantages for Residential Driveways and Gravel Surfacing - Family-Friendly Living in Singapore: Balancing Homes with Educational Access

Choosing a home in Singapore involves more than lifestyle and design—it also requires thoughtful consideration… Read more: Family-Friendly Living in Singapore: Balancing Homes with Educational Access

Choosing a home in Singapore involves more than lifestyle and design—it also requires thoughtful consideration… Read more: Family-Friendly Living in Singapore: Balancing Homes with Educational Access - Vertical Blinds Installation in Sydney for Long-Lasting Comfort and Style

Introduction Window coverings are more significant than most people think when it comes to improving… Read more: Vertical Blinds Installation in Sydney for Long-Lasting Comfort and Style

Introduction Window coverings are more significant than most people think when it comes to improving… Read more: Vertical Blinds Installation in Sydney for Long-Lasting Comfort and Style - How Does a Heat Exchanger Work?

A heat exchanger is a device specifically designed to transfer heat from one fluid to… Read more: How Does a Heat Exchanger Work?

A heat exchanger is a device specifically designed to transfer heat from one fluid to… Read more: How Does a Heat Exchanger Work?

Family-Friendly Living in Singapore: Balancing Homes with Educational Access

2026 Strategic Property Outlook: Why Tengah and Bayshore are the New Pillars of Singapore Real Estate

Why Should You Choose Vela One for Your Next Home or Investment?

Wellness and Recreational Facilities at Lentor Gardens Residences

What are the Advantages of Plate Heat Exchangers in Modern Industries?

Resin Bonded Surfaces: Best Uses and Advantages for Residential Driveways and Gravel Surfacing

Family-Friendly Living in Singapore: Balancing Homes with Educational Access