If you’re behind on mortgage payments, you’re not alone. Many homeowners find themselves in financial distress, struggling to keep up with their mortgage. However, falling behind on payments can lead to significant consequences, including foreclosure, a ruined credit score, and the loss of your home. But there’s good news: You have options. Selling your home before it’s too late can help you avoid foreclosure, recover financially, and get back on track.

In this blog, we’ll discuss how selling your home can relieve your financial burden, prevent foreclosure, and provide the necessary debt relief you need. If you’re behind on payments, this could be your solution.

How Selling Can Help You Avoid Foreclosure

Foreclosure is one of the most stressful situations a homeowner can face. It’s the legal process through which your lender takes possession of your property because of unpaid mortgage payments. Falling behind on your payments may eventually lead to this, but selling your home is one of the most effective ways to prevent foreclosure.

By selling your home, you can use the proceeds to pay off the remaining balance of your mortgage and avoid the worst-case scenario. Selling before foreclosure begins not only protects your credit score but can also prevent you from losing your home altogether. If you act quickly, you can eliminate the threat of foreclosure, keep your financial future intact, and make a fresh start.

The Benefits of Selling to Prevent Default

When you’re behind on payments, the stress can be overwhelming. But there is a solution: selling your home. Selling your home provides several key benefits that can help you regain control of your financial situation and avoid the dire consequences of foreclosure.

First and foremost, selling your home gives you the opportunity to pay off your mortgage. By doing this, you can prevent default and stop the foreclosure process in its tracks. This is the most effective way to avoid the damaging consequences of foreclosure, which can stay on your credit report for years.

Additionally, selling your home helps protect your credit score. Foreclosure is one of the most damaging events that can negatively affect your credit, but if you sell your home before foreclosure proceedings begin, you can avoid the long-term damage. By settling your mortgage through a sale, you can keep your credit score intact and avoid the financial ruin that comes with foreclosure.

Another benefit of selling is the financial relief it provides. If you’re overwhelmed with debt and facing mounting bills, selling your home can give you the financial recovery you need. The proceeds from the sale can be used to pay off your mortgage, pay down other debts, and get back on your feet. You can walk away from the property without the burden of debt weighing you down, giving you the chance to rebuild your finances and move forward.

Moreover, selling your home allows you to eliminate financial stress. No more worrying about missed payments or being harassed by your lender. By choosing to sell, you can move on with your life and focus on your financial well-being without the constant pressure of foreclosure hanging over you.

Why an Urgent Home Sale is Essential

If you’re behind on payments, time is of the essence. Every missed payment brings you closer to the possibility of foreclosure. It’s crucial to take action sooner rather than later. An urgent home sale is the best way to ensure you avoid foreclosure and prevent the situation from getting worse.

Selling your home quickly means you can settle your mortgage, avoid legal action from your lender, and get the debt relief you need. The longer you wait, the more difficult it becomes to control the situation. By choosing to sell your house now, you’re taking control of your financial future and preventing a foreclosure that could negatively impact your life for years to come.

How Selling Your Home Can Lead to Property Debt Relief

If you’re struggling with mounting debt, selling your home is one of the best ways to alleviate that burden. Instead of letting your property sit and accumulate interest while facing mounting financial difficulties, selling your house can provide the relief you need.

By selling, you can use the proceeds to pay off your mortgage and other debts, freeing yourself from the weight of financial stress. You won’t have to worry about the added pressure of unpaid bills or the threat of foreclosure. Selling your house gives you a clean slate, allowing you to move on from debt and regain control over your finances.

Additionally, selling your home before it goes into foreclosure will give you the opportunity to preserve your credit score. Avoiding foreclosure can make a huge difference in your ability to recover financially and secure favorable terms in the future, whether you’re buying a home, applying for a loan, or managing your finances.

Common Questions When Selling Your Home Due to Late Payments

- Can I still sell my home if I’m behind on payments?

Yes, you can absolutely sell your home even if you’re behind on mortgage payments. In fact, selling your home before foreclosure is one of the best ways to protect your credit and avoid further financial damage. - How quickly can I sell my house if I’m behind on payments?

Selling your house to a cash buyer can be done quickly. With a cash offer, you can close the sale in as little as a week or two, which gives you the financial relief you need without waiting months. - Will selling my home affect my credit score?

Selling your home before foreclosure can actually protect your credit score. As long as you settle the mortgage during the sale, you can avoid the significant damage that foreclosure can cause to your credit. - What if I owe more on my house than it’s worth?

If you owe more than your home’s value, you may still be able to sell through a short sale. A short sale occurs when your lender agrees to accept less than what you owe. A cash buyer can help you navigate this process to avoid foreclosure. - How can I ensure I get a fair offer for my home?

Working with a trusted cash buyer ensures you’ll receive a fair offer. A reputable buyer will base their offer on the market value of your home and its condition, providing you with a fair, competitive deal.

Sell Your House the Easy Way with Sell Today Home Buyers

If you’re behind on payments, selling your home can be the solution you need to avoid foreclosure, protect your credit score, and get the financial recovery you deserve. Whether you’re facing foreclosure, struggling with debt, or just need to move quickly, a direct sale is the simplest and fastest way to solve your problems.

Global Real Estate Solutionsspecializes in helping homeowners in difficult financial situations. We offer a hassle-free process that lets you sell your home quickly, with no commissions, no fees, and no waiting. Our team works with you to ensure a smooth and quick transaction.

Visit us today to learn more about our buying process and receive your cash offer. Don’t let missed payments lead to foreclosure—take action now and take control of your financial future before it’s too late.

- Vertical Blinds Installation in Sydney for Long-Lasting Comfort and Style

Introduction Window coverings are more significant than most people think when it comes to improving… Read more: Vertical Blinds Installation in Sydney for Long-Lasting Comfort and Style

Introduction Window coverings are more significant than most people think when it comes to improving… Read more: Vertical Blinds Installation in Sydney for Long-Lasting Comfort and Style - How Does a Heat Exchanger Work?

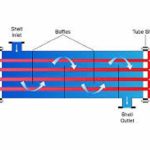

A heat exchanger is a device specifically designed to transfer heat from one fluid to… Read more: How Does a Heat Exchanger Work?

A heat exchanger is a device specifically designed to transfer heat from one fluid to… Read more: How Does a Heat Exchanger Work? - 2026 Strategic Property Outlook: Why Tengah and Bayshore are the New Pillars of Singapore Real Estate

As we cross into 2026, the Singapore residential market has entered a phase of “Sustainable… Read more: 2026 Strategic Property Outlook: Why Tengah and Bayshore are the New Pillars of Singapore Real Estate

As we cross into 2026, the Singapore residential market has entered a phase of “Sustainable… Read more: 2026 Strategic Property Outlook: Why Tengah and Bayshore are the New Pillars of Singapore Real Estate - The Essential Role of Builder’s Bags in Today’s Construction and Trade Industries

If there’s one item you’ll find on almost every construction site in the UK, it’s… Read more: The Essential Role of Builder’s Bags in Today’s Construction and Trade Industries

If there’s one item you’ll find on almost every construction site in the UK, it’s… Read more: The Essential Role of Builder’s Bags in Today’s Construction and Trade Industries - Hello Services – Professional Cleaning and Property Services Across the UK

When it comes to maintaining a clean, safe, and well-managed property, choosing a reliable service… Read more: Hello Services – Professional Cleaning and Property Services Across the UK

When it comes to maintaining a clean, safe, and well-managed property, choosing a reliable service… Read more: Hello Services – Professional Cleaning and Property Services Across the UK

2026 Strategic Property Outlook: Why Tengah and Bayshore are the New Pillars of Singapore Real Estate

Why Should You Choose Vela One for Your Next Home or Investment?

Wellness and Recreational Facilities at Lentor Gardens Residences

Terra Hill: Premium Freehold Residences in the Heart of Pasir Panjang

A Tranquil Escape in the City

Therapeutic Foster Care: Specialised Support for Children Who Need It Most

Retail Therapy and Boutique Shopping Near Zyon Grand